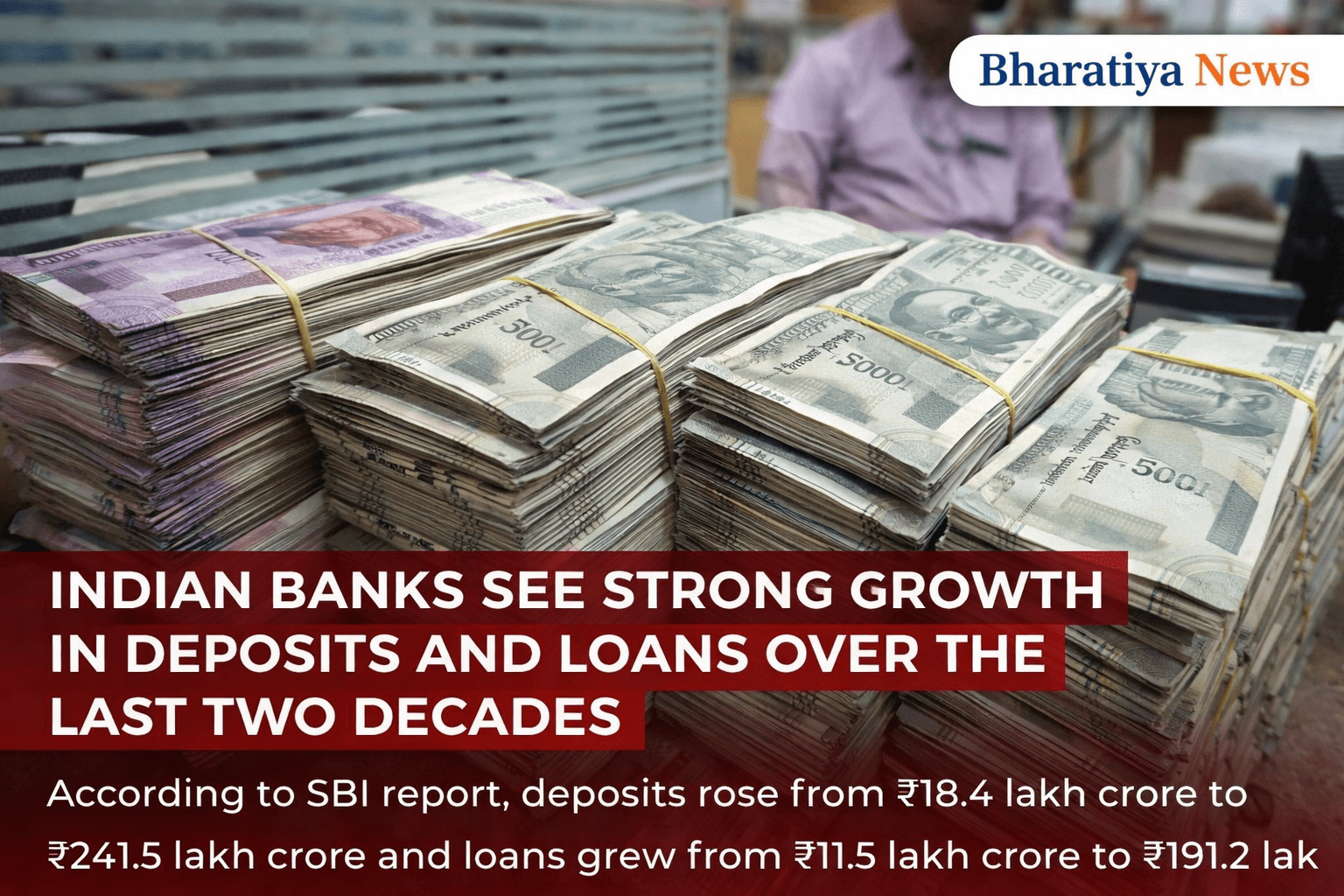

Indian Banks Record Strong Growth in Deposits and Loans Since FY05: SBI Report

New Delhi | January 12, 2026

India’s banking sector has witnessed significant expansion over the past two decades, with sharp growth in both deposits and loans, reflecting the increasing depth and scale of financial intermediation in the country, according to a recent report released by the State Bank of India (SBI).

The report highlights that between FY05 and FY25, total bank deposits rose substantially from ₹18.4 lakh crore to ₹241.5 lakh crore. During the same period, bank advances also recorded strong growth, increasing from ₹11.5 lakh crore to ₹191.2 lakh crore, indicating sustained demand for credit across the economy.

SBI noted that the pace of growth in deposits and advances has accelerated further since FY21, supported by improved economic conditions and a post-pandemic recovery in banking activity.

The report also pointed to a notable revival in bank balance sheets following the pandemic. Total banking assets, which stood at around 77 per cent of India’s GDP earlier, increased to approximately 94 per cent of GDP by FY25. This trend underlines renewed credit expansion and deeper financial penetration within the economy.

According to the findings, while both deposits and loans have expanded significantly, advances have grown at a relatively faster rate, signalling strong credit uptake.

Public Sector Banks (PSBs) have also shown signs of recovery. After losing market share steadily since FY08, PSBs are gradually regaining their position in advances. This turnaround reflects strengthening balance sheets and renewed lending appetite among public sector lenders.

On the deposits front, the report observed that the overall CASA (Current Account Savings Account) ratio across the banking system has remained stable at around 37 per cent. However, variations exist among different bank groups, with private sector banks improving their CASA share, while foreign banks witnessed a decline.

Additionally, the total asset size of Indian banks has expanded sharply, growing from ₹23.6 lakh crore in FY05 to ₹312.2 lakh crore in FY25. SBI noted that after slowing to single-digit growth between FY15 and FY21, asset growth has rebounded strongly in recent years.

The report concludes that these trends collectively indicate a large-scale expansion of India’s banking system, driven by improved asset quality, stronger credit demand, and broader financial inclusion.

(Except for the headline, this story has not been edited by Bharatiya News staff and is published from a syndicated feed.)